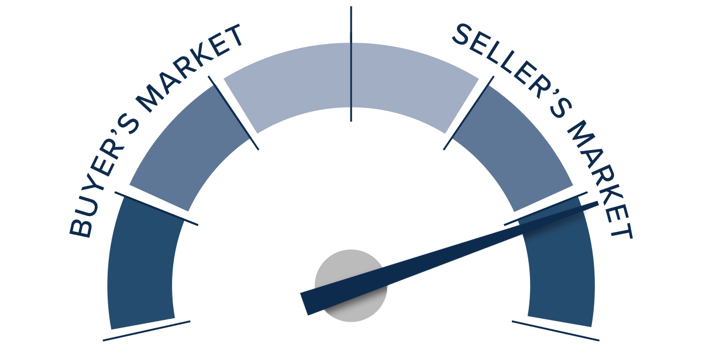

April 2025 was a Seller's market! The number of for sale listings was up 35.1% from one year earlier and up 27.7% from the

previous month. The number of sold listings decreased 2.7% year over year and increased 7.9% month over month. The number

of under contract listings was up 12% compared to previous month and up 0.4% compared to previous year. The Months of

Inventory based on Closed Sales was 2.5, up 39.2% from the previous year.

The Average Sold Price per Square Footage was up 3.3% compared to previous month and down 0.9% compared to last year.

The Median Sold Price increased by 3.5% from last month. The Average Sold Price also increased by 4.3% from last month.

Based on the 6 month trend, the Average Sold Price trend was "Neutral" and the Median Sold Price trend was "Appreciating".

The Average Days on Market showed a downward trend, an increase of 3.4% compared to previous year. The ratio of Sold Price

vs. Original List Price was 99%, was the same compared to previous year.